Support for mineral exploration in B.C.

A popular provincial tax credit program that supports mineral exploration will continue for another year

If you pay taxes in B.C. and have some funds available for investment, you might want to consider putting them into junior resource exploration companies in this province.

In late January 2014, Premier Christy Clark announced the continuation of a scheme that’s a great deal for investors and the companies they put their money into. It’s the British Columbia Mining Flow-Through Share Tax Credit program.

“The program has been in effect since the ’80s, but there’s no guarantee that it will continue,” said Tim Termuende, president and CEO of Eagle Plains Resources Ltd. “It’s on the table every year at budget time, and fortunately the government does realize what an important tool it is to foster exploration.”

Termuende explained that the program is available only to junior resource exploration companies—those that do not have an income-generating mine. Juniors are companies that are established for the sole purpose of carrying out exploration using public funds, and they rely on investors to bring in money for exploration.

Lloyd Addie, president of the Chamber of Mines of Eastern B.C., offered further information about the role of a junior company.

“When a junior exploration company finds a potentially economic mineral deposit, they can either mine it themselves or sell it to a major mining company that has the expertise to put it into production,” said Addie.

In simple terms, the program gives taxpaying B.C. residents the opportunity to invest in mineral exploration and get substantial short-term tax savings to offset the investment, while the investment itself continues to have the potential for its own payday. The program provides an incentive to investors to help stimulate exploration, and it provides a taxable benefit—you get to write off a big portion of your investment on your personal income tax return.

Though there are rules and restrictions that make the program a lot more complicated than that, it has many enthusiastic supporters.

“We’ve probably put $1 million into the ground in the Kootenays using flow-through funding over the years,” Termuende said. “It’s a risky business though—you’re investing in companies that are hoping to find something, and quite often they don’t.”

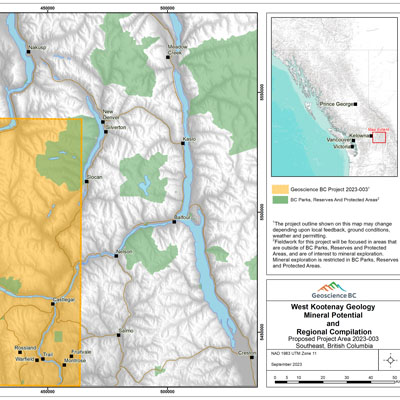

In the Kootenay region, the roster of junior resource exploration companies includes Eagle Plains Resources Ltd., Santa Fe Metals, Omineca Mining & Metals, PJX Resources, and Silver Mountain Mines Inc.—and there are more. If they choose to participate in the flow-through share tax credit program, these companies can benefit in a variety of ways. The funding is to be used specifically for exploration, including drilling, soil sampling and geophysics.

“That money from the government is earmarked towards finding a (mineral) deposit,” said Termuende. “You can only use the money for exploration-related expenses, including wages, analytical results, fuel, helicopters, equipment, services and such. It’s a really good way to oil the economic wheels in a community, because the money spreads through the community. It’s the government’s way of helping exploration companies, which in turn benefits local economies.”

Comments