Balancing risks

The success of Eagle Plains Resources Ltd. is no flash in the pan

Resource exploration has been a risky and expensive business from the very beginning. From the time of the first gold strike, more money has been made by those who supply the miners than by the miners themselves. These days, though, instead of shovels and mules and groceries, the supplies include diamond drills and helicopters and expensive office space.

Cranbrook-based Eagle Plains Resources Ltd. has been in business for 20 years, and that’s a big milestone for a junior exploration company. According to some pundits, the average lifespan for this type of company is about one-tenth of that. There are a couple of reasons for that short life: one is insolvency and another is that the companies in question may have consolidated their share structure significantly by conducting rollbacks, often to the detriment of investors.

Applauding prudence

Mike Labach, investor relations manager for Eagle Plains Resources, is clear about how Eagle Plains managed to reach this milestone.

“It comes down to the management’s integrity, prudence and common sense practices,” he said. “Eagle Plains has found ways to generate revenue, offset expenses and build its assets. Management has been smart and responsible, and this has put us in a good position.”

Reputation is all

As a project generator company, Eagle Plains forms partnerships with other companies to advance its properties. Labach said that when other companies seeking exploration projects in the industry get to know and trust your business practices and your word, and know that you’ve had exploration success in this expensive and high-risk business, they’re inclined to be willing to work with you.

Resource exploration is an industry founded on speculation, even for the most reputable companies using the best information available, and investing is very much a buyer-beware situation. Mark Twain once said that a gold mine is a hole in the ground with a liar standing on top.

“I think that a lot of hopes and dreams have been lost, along with a lot of money, in bad deals with questionable companies,” Labach said. “Our management has been prudent with money, smart with their business model and strategic with their locale.

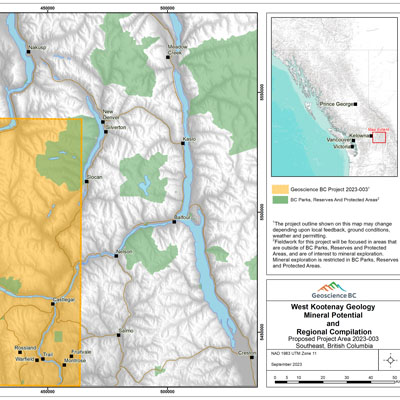

“We own some major real estate assets in the community, and we employ between 16 and 50 people, depending on the season. The company has more than 40 projects in Western Canada, and 20 per cent of them are in the East Kootenay, close to our office. The proof is really in the pudding. We have 83 million shares outstanding and $6 million in cash and shares in the bank and have never consolidated the share structure. That’s exceptional for a 20-year-old junior company in our industry.”

The lode that beckons

Eagle Plains has focused most intensely on two areas in recent years—the Aldridge Basin in southeastern B.C. and the Athabasca Basin area of northern Saskatchewan.

“Locating another SEDEX deposit like the Sullivan Mine is our focus in the East Kootenay,” Labach said. “A find like this could add significantly to the value of the company.”

Comments