Cryptocurrency comes to the Kootenays

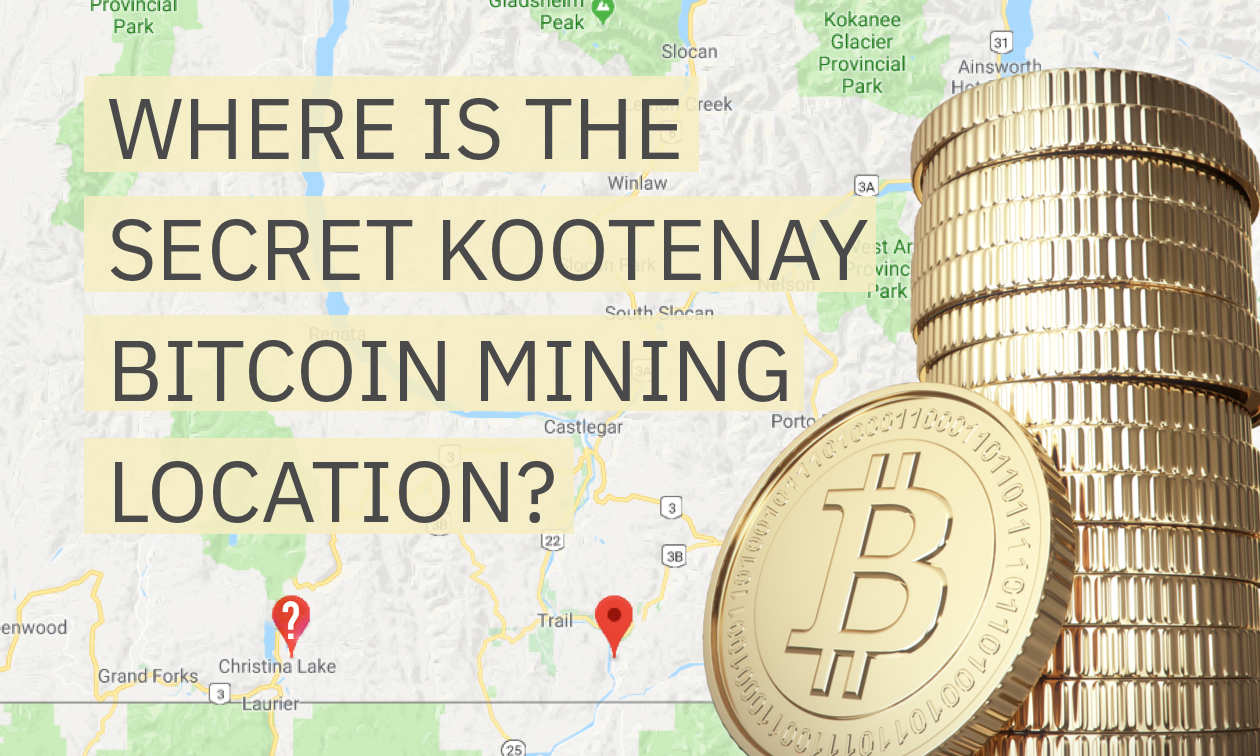

Part II. The secret bitcoin location in the Kootenays

— Background image Bob Morton photo

Various sources indicate that a massive DMG cryptocurrency mine facility is located near Christina Lake, B.C., and more of the company’s facilities are situated in the Trail, B.C. area.

For example, Trail’s Metal Tech Alley includes them in its inventory of companies stating, “Digital Mint Group (DMG) Blockchain Solutions Inc. is a full service blockchain, cryptocurrency and smart contracts company that manages, operates and develops end-to-end digital solutions to monetize the blockchain ecosystem.

We are incredibly pleased to welcome these new additions (including DMG) to the Kootenay region’s ever-growing cluster of great minds,” said Terry Van Horn, executive director, Lower Columbia Initiatives Corporation. “These companies recognize the “global” reach this region has and the huge potential in the “big data” and IoT sectors the metal tech alley‘s region is leading.”

A tech industry newsletter called Deep Dive states, “As it currently stands, DMG Blockchain leases three separate facilities within Western Canada, all for the purpose of Bitcoin mining.

— Photo courtesy Creekside Industries Ltd.

First Facility: Located in Edmonton Alberta, the facility is 3,600 square feet. Currently, rent is paid at a rate of $3,937.50 per month. This is the location of DMG’s 300 mining rigs, of which 245 are currently operational.

Second Facility: Based in Trail, BC, DMG Blockchain’s second facility is 3,400 square feet in size. Rent is at an undisclosed rate. 600 mining rigs currently operate out of this facility, which are owned by one of DMG’s clients.

Third Facility: Currently leased from Creekside Industries, the location of the third and newest facility is undisclosed. However, based on some Google sleuthing it is believed that it is located in Christina Lake, BC. The facility itself is 27,000 square feet, and comes with 34 acres of land. DMG pays rent of $6,000 per month for the facility, plus utilities and taxes, and has the option to purchase the facility for $950,000. No operations have been established here as of yet, however it is in the process of being established.”

The newsletter goes on to state, “By all accounts, DMG Blockchain intends to make the third facility it’s only facility. Upon establishing operations at this facility, everything from the Edmonton location will be relocated to here. Based on the success of this, the second facility will likely be relocated to here in a short time frame as well. An application has been made to receive 40 MW servicing at the facility, and investor presentations indicate there is the capability for it to be upsized to as large as 85 MW.”

Deep Dive referenced a direct quote from DMG’s securities filing which states, “Subscriber demand for Maas from the Bitmasters network is expected to be met by DMG in the spring of 2018. Most of the servers will be hosted a DMG’s new industrial mining facility, which is comprised of a 27,000 square foot building on 34 acres in Western Canada. DMG has the ability to expand the hosting center with containers or new buildings by an additional 75,000 square feet to accommodate additional demand subject to obtaining the necessary permits.”

The newsletter further states, “In its current state, this remotely located facility can currently accommodate 14,000 to 20,000 mining rigs according to the company’s filing statement. This is based on a building footprint of 27,000 square feet. However, in a December 14, 2017 news release the company stated that it can be expanded by up to 75,000 square feet as seen above. As such, this facility will be able to grow with the company for an extended period of time, due to the minimal spacial requirements for the company’s operations.”

Deep Dive concludes, “Just from the mining side of the operation, this is estimated to be over $27 million annually based on current Bitcoin prices. The multiple potential joint ventures the company has engaged in are not factored in to this projected revenue figure either. Provided the price of Bitcoin can stabilize in the current range, this could be a very profitable venture.”

In January, it was reported by the Financial Post, “Online lender Mogo Finance Technology Inc. says it has formed a new subsidiary to begin bitcoin mining through an agreement with Vancouver-based DMG Blockchain Solutions Inc.

Mogo Blockchain Technology Inc. says it will initially lease 1,000 bitcoin mining machines to be managed and operated by DMG at its facilities in British Columbia.”

CBC technology reporter Eric Collins also recently documented more details about DMG investment in the West Kootenay: “Near Castlegar in southern B.C., Sheldon Bennett's company, DMG Blockchain Solutions, is putting the finishing touches on its new mine. The exact location of the thousands of rigs is a secret, but what they are doing is not. The computers are used to confirm bitcoin transactions and the miner, DMG in this case, is paid the digital currency in return for its services.”

Collins explained further, “Basically, miners like Bennett and his company are paid to act as the middlemen for bitcoin transactions, confirming who is transferring bitcoin to whom, and when. Inside DMG's 27,000-square-foot bitcoin mine — which employs about 20 people but is still ramping up — it is very loud as large fans try to cool the massive racks of computers that run around the clock. Of course, all of those machines confirming all of those transactions need a lot of power. Some analysis suggests digital currency miners around the world used more power than the entire country of Ireland last year.”

Here is link to the entire CBC report: http://www.cbc.ca/news/business/bitcoin-mining-electricity-canada-1.4543319

Another investment newsletter called Ahead of the Herd wrote, “According to DMG's February filing on SEDAR, the company plans to make its newest BC facility – where a few megawatts of mining has already started – its primary bitcoin mining facility. Servers and infrastructure have already moved from Alberta to the BC facility and its second facility, also in BC, has already shifted its miners to the new consolidated mining facility. The 40MW of power would be added to this facility (with capacity for 85MW) and according to the filing, the building can accommodate 25,000 to 30,000 servers, with more land available on the 34-acre site if additional buildings and servers are needed… With DMG's new facility, accessing up to 85 MW of power and tens of thousands of ASIC miners, DMG is setting itself up to be a major force in bitcoin mining. As of the end of January DMG had $27,969,328 in funding available. The bulk of the money ($10.5 million) is earmarked for bitcoin mining.”

Comments